Best Accidental Insurance Plan and Term Insurance: A Complete Guide

In today’s uncertain world, having the right insurance coverage is crucial for financial security. Whether it’s an accidental insurance plan or a term life insurance policy, choosing the right coverage can protect you and your family from unexpected financial burdens. Insuremile offers a range of insurance solutions tailored to your needs. This blog will guide you through the Best Accidental Insurance Plan and the differences between term insurance and life insurance, helping you make an informed decision.

Understanding Accidental Insurance Plans

Accidental insurance is a type of policy that provides financial support in case of accidents that result in disability, injury, or death. It ensures that the insured or their family members receive compensation to cover medical expenses, lost income, and other financial burdens.

Key Features of an Accidental Insurance Plan

-

Coverage for Accidental Death: If the policyholder passes away due to an accident, their nominee receives a lump sum benefit.

-

Permanent and Partial Disability Cover: If an accident leads to disability, the insurance provides financial assistance based on the severity of the condition.

-

Hospitalization Benefits: Covers medical expenses related to accident-related treatments.

-

Daily Cash Allowance: Some policies offer daily cash benefits to cover hospitalization costs.

-

Education and Family Benefits: Some plans provide financial aid to dependents in case of the insured’s demise.

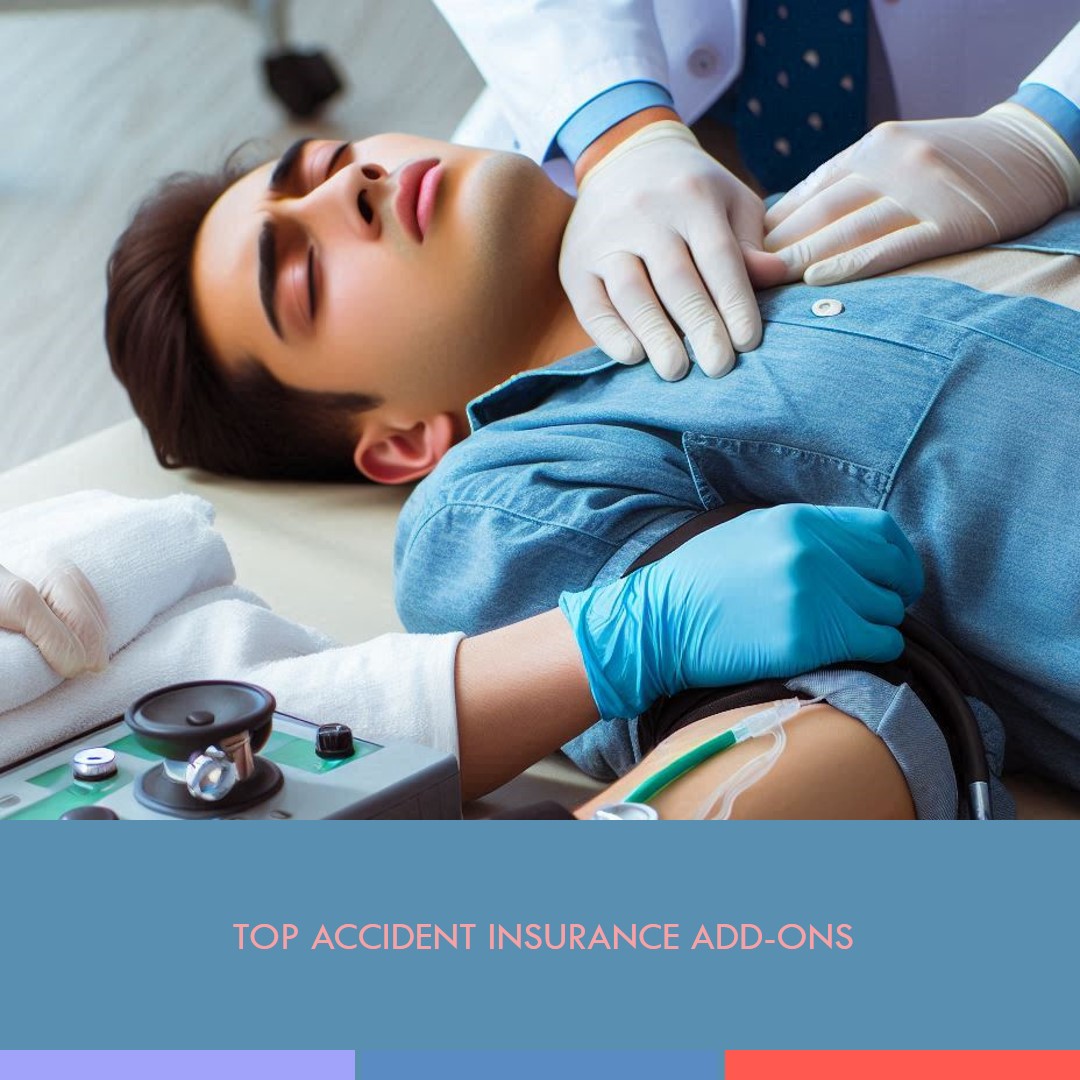

Benefits of Choosing the Best Accidental Insurance Plan

-

Financial Security for Family: Provides immediate financial relief to dependents.

-

Affordable Premiums: Compared to health or life insurance, accidental insurance has lower premiums.

-

Quick Claim Settlement: Faster claim processing for accident-related cases.

-

Worldwide Coverage: Many policies provide global coverage, ensuring protection anywhere.

Term Insurance vs. Life Insurance: What’s the Difference?

Many people get confused between Term Insurance and Life Insurance. While both provide financial security, they serve different purposes.

What is Term Insurance?

Term insurance is a pure life insurance policy that provides coverage for a specific period. If the insured person passes away within the policy term, the nominee receives a lump sum payout. However, if the policyholder survives the term, no benefits are paid.

Features of Term Insurance

-

Affordable Premiums: Term insurance offers high coverage at lower premiums.

-

Death Benefit: Pays a lump sum to beneficiaries upon the policyholder’s death.

-

Flexible Policy Terms: Coverage can range from 5 years to 40 years.

-

Riders Available: Additional benefits such as critical illness, accidental death, or disability riders can be added.

What is Life Insurance?

Life insurance provides financial protection along with investment benefits. There are different types of life insurance policies, including whole life insurance, endowment plans, and ULIPs (Unit-Linked Insurance Plans).

Features of Life Insurance

-

Maturity Benefit: Offers a payout even if the policyholder survives the term.

-

Investment Component: Some policies allow wealth accumulation.

-

Loan Facility: Policyholders can take loans against the policy.

-

Higher Premiums: Compared to term insurance, life insurance premiums are higher due to added benefits.

How to Choose the Right Insurance Plan?

When selecting between an accidental insurance plan, term insurance, or life insurance, consider the following factors:

1. Financial Needs

-

If you want coverage only for accidental injuries, go for accidental insurance.

-

If you need pure life coverage at a low cost, term insurance is the best.

-

If you want life cover along with savings, choose life insurance.

2. Premium Affordability

-

Accidental insurance has the lowest premiums.

-

Term insurance is affordable but provides only death benefits.

-

Life insurance is expensive but offers investment benefits.

3. Family Protection

-

If you have dependents, term insurance provides financial security.

-

Accidental insurance can supplement existing life insurance.

-

Life insurance ensures a long-term wealth-building strategy.

Why Choose Insuremile for Your Insurance Needs?1. Customized Insurance Plans

Insuremile provides a variety of insurance plans, including the best accidental insurance plan, term insurance, and life insurance tailored to meet your specific needs.

2. Competitive Premiums

We offer affordable premiums without compromising on coverage and benefits.

3. Quick and Hassle-Free Claims

Our seamless claim settlement process ensures that your loved ones receive the benefits without delays.

4. Expert Guidance

Our insurance experts help you choose the best policy based on your financial goals.

Conclusion

Choosing the right insurance policy is an essential step towards financial security. Whether you opt for an accidental insurance plan, term insurance, or life insurance, Insuremile provides the best solutions to safeguard your future. Evaluate your needs, compare plans, and invest in the right policy today!