Chit Fund Chronicles: How Small Contributions Build Big Dreams

In the bustling lanes of Indian towns and cities, a quiet revolution has been taking place for decades. It doesn’t make headlines, and it doesn’t always wear a suit and tie. Yet, it’s helping millions achieve their dreams—one small step at a time. This is the world of Chit Funds, a humble but powerful financial tool that’s making a difference in everyday lives.

What Is a Chit Fund, Really?

Let’s keep it simple. A Chit Fund is a type of savings and borrowing scheme rolled into one. A group of people come together and contribute a fixed amount every month. This pooled amount is then given to one member of the group through a bidding or lottery system. The cycle continues until everyone has had their turn.

Sounds basic? It is. But behind this simplicity lies a system that has helped people send their kids to school, build houses, start small businesses, and manage medical emergencies without going to a bank.

Real People, Real Stories

Meet Anita, a tailor from a small town in Maharashtra. Every month, she contributes ₹1,000 to her local chit group. After eight months, she finally got her turn and received ₹17,000. That’s how she bought a new sewing machine and doubled her income.

Or take the story of Ravi, an electrician in Hyderabad. He used his Chit Fund payout to pay for his daughter’s college admission. No paperwork. No waiting. Just trust and timely support.

These aren’t rare stories. They’re happening all around us. And they all begin with small, regular contributions and a shared goal.

Why Do People Trust Chit Funds?

Let’s face it. Banks and formal financial institutions can be intimidating. High interest rates, hidden charges, credit checks—it’s not always easy, especially for someone with no financial history. That’s where a Chit Fund feels like a friend.

Community-based: You usually know the people involved—friends, neighbors, or coworkers.

Flexible: There’s no need for collateral or credit scores.

Quick access to cash: Once it’s your turn, you get the money when you need it.

Disciplined saving: It encourages a regular habit of saving, which often feels easier when you’re doing it with others.

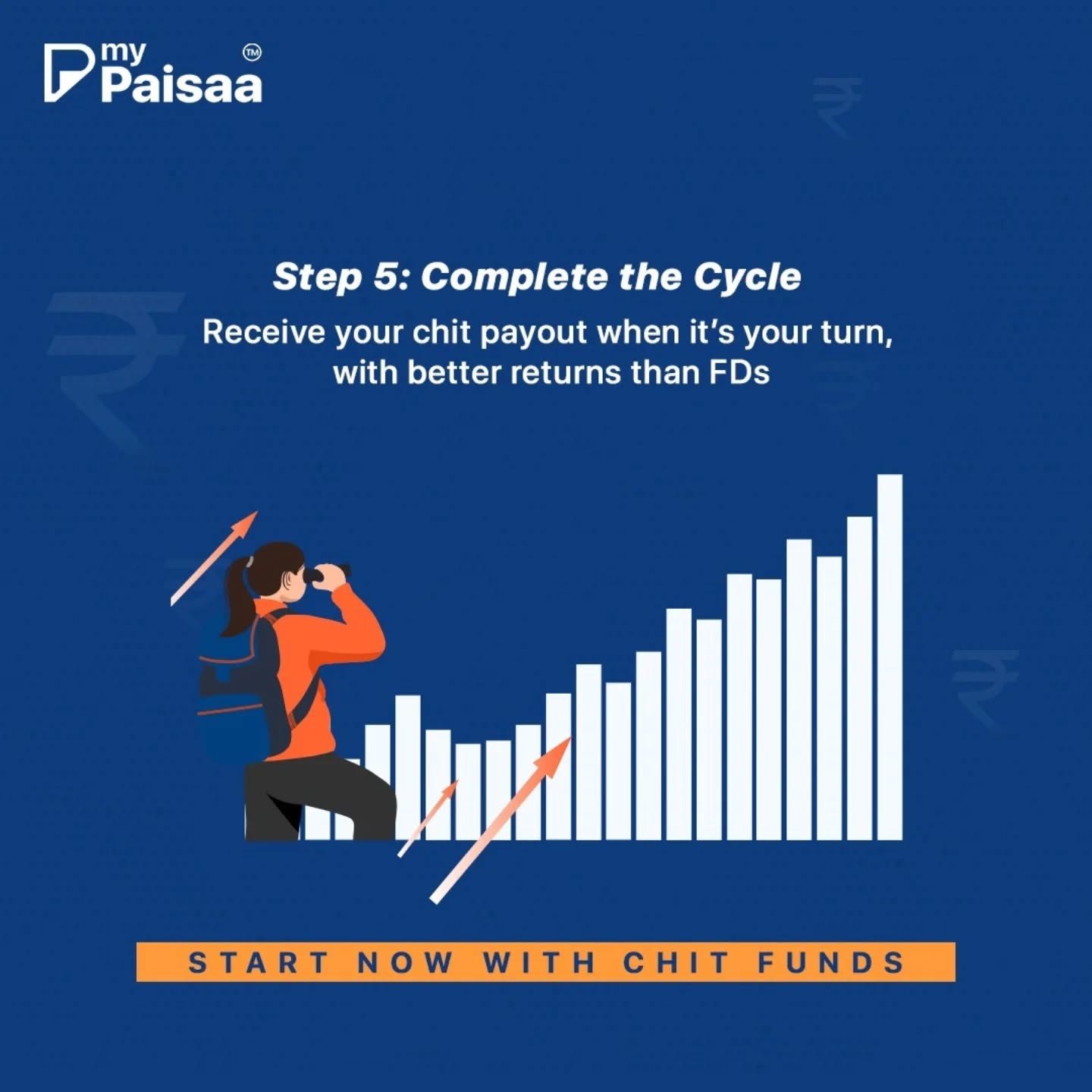

The Power of Small Contributions

We often underestimate how small actions lead to big results. Think about it—₹500 or ₹1,000 a month might not feel like much, but over time, it adds up. And when pooled together in a Chit Fund, it becomes a powerful force for change.

Let’s break it down.

A group of 20 people contributes ₹1,000 each.

That’s ₹20,000 in the pot every month.

One person gets the amount, and the cycle continues.

In less than two years, each member will have received a lump sum they can use in a meaningful way.

It’s not a loan. It’s not a gamble. It’s planned, purposeful, and built on trust.

Make Your Money Move with My Paisaa

Now, imagine taking this traditional system and giving it a smart twist. That’s exactly what My Paisaa does. With just a few taps on your phone, you can now join a chit group from the comfort of your home. No paperwork. No hassle.

Take control of your finances. Join a chit group. Start saving.

My Paisaa brings the warmth of community and the power of technology together. You stay in charge, stay informed, and stay secure.

Choose your group size

Track your contributions

Withdraw with ease

Stay updated in real-time

This isn’t just a financial tool—it’s a movement. One that puts power back in your hands.

Chit Funds Are More Than Money

A Chit Fund is more than a financial system. It’s a circle of trust. A support system. A way for people with limited means to dream big—and actually make those dreams happen.

It teaches discipline. It builds accountability. And it brings people together in a way that few financial products ever do.

It’s not just about money—it’s about what you can do with it.

Start a shop

Repair your home

Invest in a skill

Pay off debts

Celebrate a wedding

Fund education

These are the moments that make life meaningful. And a Chit Fund helps make them happen, one contribution at a time.

Final Thoughts

You don’t need to be rich to dream big. You just need a plan—and a little help from your community. That’s the heart of a Chit Fund.

So if you’ve ever felt left out of the banking system, or if you’re looking for a smarter way to save and access funds, don’t ignore this time-tested tool. It’s simple. It works. And it has already changed millions of lives.

Take the first step with My Paisaa. Join a chit group today. Watch your small contributions build a bigger, brighter future.