What is indirect tax services?

What Are Indirect Tax Services in India?

Indirect tax services refer to professional advisory and compliance solutions offered by tax experts, consultants, or firms to help businesses manage taxes that are not directly paid by consumers to the government but are instead collected by intermediaries (like sellers or service providers) and paid on their behalf.

Key Features of Indirect Taxes in India:

- Collected by one person (e.g., seller) but borne by another (e.g., consumer)

- Applied on goods and services (not on income or profits)

- Paid at multiple stages — manufacturing, distribution, or sale

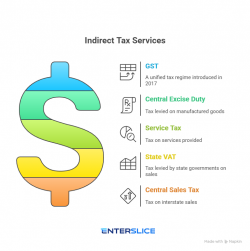

Main Types of Indirect Taxes in India:

Goods and Services Tax (GST) – Unified tax structure covering:

CGST (Central GST)

SGST (State GST)

IGST (Integrated GST for inter-state transactions)

Customs Duty – Tax on import and export of goods

Excise Duty – Levied on manufacturing of goods (now mostly merged into GST except for specific products like liquor, tobacco, and petroleum)

Stamp Duty – Tax on legal documents (property transactions, agreements)

What Do Indirect Tax Services Include?

GST Registration & Compliance

Obtaining GSTIN

Filing monthly/quarterly/annual returns (GSTR-1, GSTR-3B, GSTR-9, etc.)

Advisory Services

Structuring transactions for tax efficiency

Classification of goods/services

Place and time of supply analysis

Tax Planning & Optimization

Input Tax Credit (ITC) planning

Managing reverse charge mechanism (RCM)

Minimizing tax liability legally

Representation & Litigation Support

Handling tax audits and assessments

Responding to GST notices and inquiries

Representation before appellate and judicial authorities

Customs & Import-Export Advisory

Assistance in valuation, classification, and duty calculation

Managing import-export documentation and clearance

Compliance Health Check & Audit

Reviewing internal compliance systems

Conducting GST health checks to ensure accuracy and avoid penalties

Training and Updates

Training for in-house finance and tax teams

Sharing regular updates on changes in tax laws and notifications